Fixed Income Outlook: Why flexibility will be key for fixed income investors in 2026

KEY POINTS

Despite no shortage of challenges and obstacles, returns across fixed income asset classes have been largely positive in 2025, with income levels a major contributing factor.

However, as we enter the coming year, markets face potentially slower economic growth, alongside questions over the direction of monetary policy and inflation, as trade policy uncertainty dominates the discourse.

What is certainly clear is that investors will need to be more malleable in their investment approach going forward – flexibility will be paramount to ensure they can steer through the market unpredictability.

Four fixed income experts share their views on what to look out for in markets in 2026.

By BNP Paribas Asset Management, Head of Global Aggregate and Absolute Return, James McAlevey

Over recent years investors have had to navigate a plethora of challenges – geopolitical uncertainty, central bank resetting and more recently a spate of US trade tariffs.

However, we are amid a very different setting to the interest rate recalibration period of 2022-2024, and the environment continues to evolve at pace. Many central banks are now cutting interest rates – good news for traditional bond strategies – but uncertainty remains ever-present.

The depth and speed of future interest rate cuts remains in question. Inflation is proving more stubborn than anticipated in many economies – and US tariff policies could push prices higher in 2026. We may be entering a new era of structurally higher inflation, meaning that interest rates may not fall as far in the current cycle as many hope. This, combined with a weaker outlook for economic growth, puts central banks in a difficult position.

And while fixed income has become much more attractive now that yields have risen from their ultra-low levels of five years ago, the outlook is far from straightforward. But as we move into 2026, what is more certain is that a flexible, diversified and dynamic investment approach to bond investing will be key.

And while markets can always be turbulent, volatility brings with it opportunities – and right now we are seeing investment potential across global bond markets. For example, the trend towards a weaker US dollar is particularly favourable for some issuers in the local emerging market universe where relatively high yields offer compensation commensurate with the associated risk. In developed markets, current coupon US agency mortgage-backed securities currently offer a pickup in yield relative to US investment-grade corporate debt with lower credit risk.

Looking ahead, given the complications surrounding cross-border trade, alongside the high levels of government debt – plus ongoing geopolitical tensions, it seems logical that investors will require additional compensation for holding longer maturity government debt. That would mean steeper yield curves. The unconstrained nature of our absolute return opportunity set enables us to position portfolios to benefit from steeper yield curves, another example of the advantages of being able to both overweight and underweight fixed income assets.

This economic uncertainty continues to cloud the fixed income market outlook. Fundamentally, we believe that significant risks remain for investors pursuing traditional, less flexible, fixed income strategies. Higher volatility has widened the gap between the best- and worst-performing areas of the fixed income universe. In today’s shifting and uncertain economic landscape, something which will no doubt spill into 2026, a global, flexible approach will be as essential as it ever has been.

By AXA IM, Head of Euro Investment Grade and High Yield Credit, Boutaina Deixonne

European markets have been far from immune to the numerous volatility spikes of recent years, but despite a challenging environment, corporates have been able to adapt – even flourish.

But as we head into 2026, there are few issues to consider – the two most pertinent being potentially softer GDP growth and the possible implications for monetary policy.

Central banks may likely continue to cut interest rates, and inflation may trend lower, but it may still be a more challenging period, especially considering the potential impact of US trade tariffs. Investors will need to take a flexible, unconstrained approach and adopt strategies which aim to help them manage credit spread and duration risk.

Despite the numerous headwinds – either already present or potentially on the horizon – we see plenty of opportunities across a wide variety of industries including more defensive sectors such as utilities and telecommunications as well as real estate, which enjoys inflation-beating rental growth projections.

These sectors remain robust and tend to demonstrate strong balance sheets, while valuations are very attractive compared to more cyclical areas. In addition, the banking and financial sector is also very attractive. Banks, due to strict regulatory requirements, are already in strong health and boast good margins, and robust capitalisation. Indeed, banks’ profitability is likely to continue to be supported by asset-gathering fees.

Flows into European credit have been very buoyant as the search for yield shows no signs of easing. And with European investment grade bonds boasting yields of circa 3% to 3.5% and high yield around 5%, we anticipate this trend will continue well into 2026, as the attraction of cash instruments and money markets will likely be lower.

Fundamentally, European bond markets are offering decent income levels and demand is likely to rise as investors look to lock in attractive yields. European issuers’ credit quality remains in good health, which should help buffer them against a potential economic slowdown. But given the plethora of macroeconomic uncertainties concerning growth, government deficits, inflation and monetary policy, we believe going forward it will be essential that investors adopt a nimble, flexible approach to asset selection when navigating the current climate.

By AXA IM, Head of US High Yield, Michael Graham, and US Fixed Income Investment Specialist Jack Stephenson

For the best part of three years, the US economy has defied expectations for a recession and has continued to outperform other developed market economies.

For US high yield, despite bouts of volatility related to interest rates, regional banks and tariffs, this period has been defined by strong investment returns reflecting fundamental strength, very low defaults and an abundant supply of capital to issuers underpinning a strong technical across all leveraged finance.

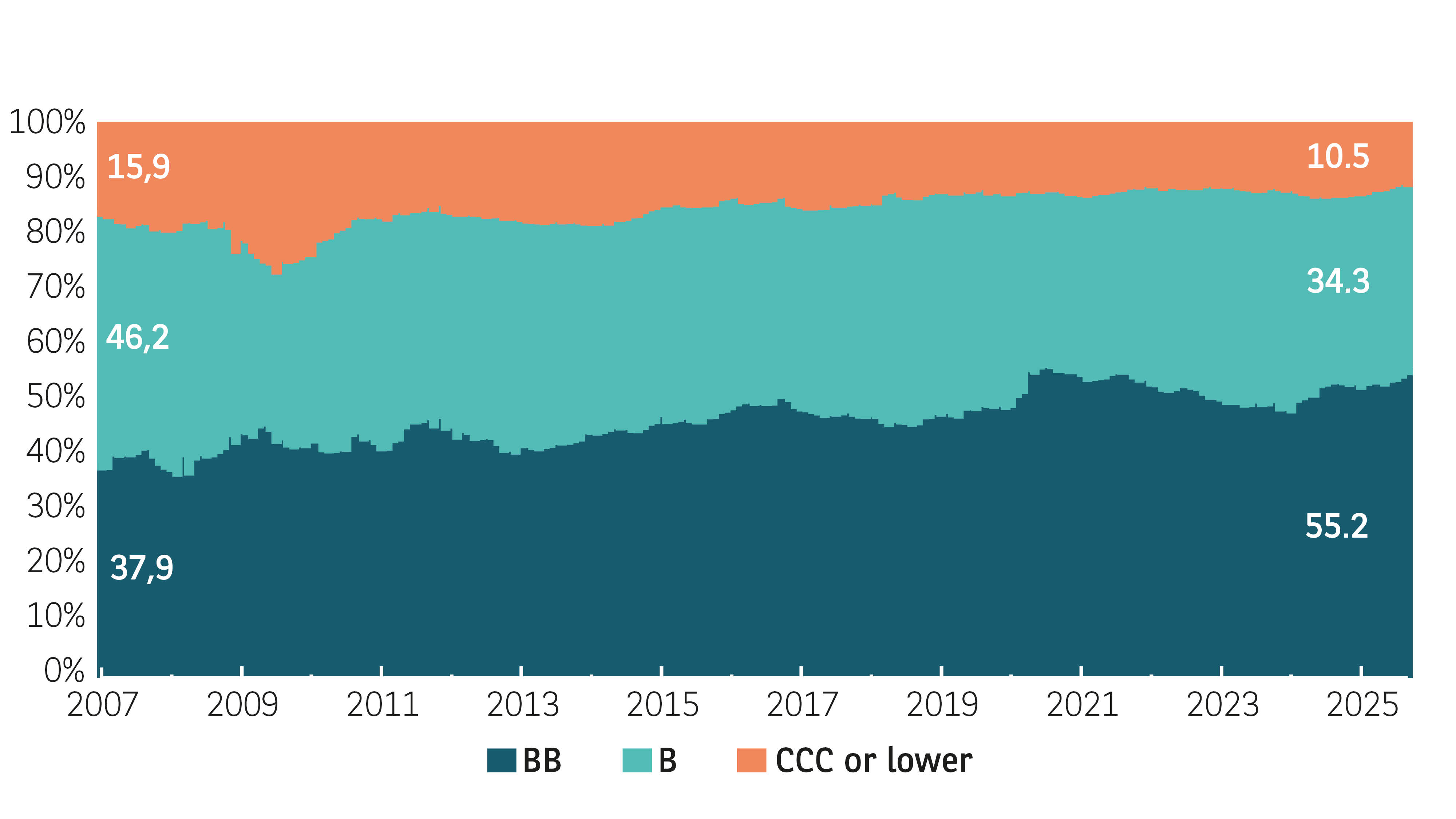

Reflecting this healthy backdrop, spreads have continued to tighten, leading to questions about how much more room to run there may be in 2026. It is worth remembering that, whilst spreads appear low in a historical context, they are much less so when adjusted for today’s US high yield market composition. Current spread levels are supported by a near record high percentage of BBs; a near record low percentage of CCCs; a record high percentage of secured bonds (35%); and record low duration and low bid/ask spreads (i.e. better liquidity)1.

Still, the abundant supply of capital has led to increased corporate leverage in pockets of the global leveraged finance universe, particularly the lower end of the credit spectrum in the broadly syndicated loan and private debt markets. Recently, there has been greater attention to some notable default stories and investor concern regarding contagion risk across credit markets.

Exhibit 1: Composition of the US high yield bond market by selected ratings

Data as at 30 September 2025. Source: Bank of America, HY Research

- Bank of America September 2025

Although we expect the theme of liability management exercises to remain prevalent in 2026, overall default activity in high yield should remain modest and will likely continue to be driven by idiosyncratic credit stories. In that context, an active and disciplined approach to investing within lower credit quality markets may be warranted.

Despite macroeconomic uncertainty, we expect high yield spreads to remain in a relatively tight range, supported by continued investor demand from yield buyers focused on the overall total return potential on offer as cash rates decline. We believe that short duration securities will remain attractive given the ability to mitigate both interest rate and spread volatility, whilst offering access to the most liquid part of the market. For investors seeking higher total returns within US high yield, any market weakness like we saw in April 2025, could provide potentially attractive buying opportunities further up the risk spectrum.

To benefit from the full range of opportunities, in 2026 investors may want to consider a flexible and targeted approach to investing in the high yield market, harnessing its unique diversification benefits to complement an overall asset allocation.

| “We expect high yield spreads to remain supported by investor demand as cash rates decline.” |

Disclaimer

Comunicazione di marketing: Prima dell’investimento in qualsiasi fondo gestito o promosso da AXA Investment Managers o dalle società ad essa affiliate, si prega di consultare il Prospetto e il Documento contenente le informazioni chiave per gli investitori (KID). Tali documenti, che descrivono anche i diritti degli investitori, possono essere consultati - per i fondi commercializzati in Italia - in qualsiasi momento, gratuitamente, sul sito internet www.axa-im.it e possono essere ottenuti gratuitamente, su richiesta, presso la sede di AXA Investment Managers. Il Prospetto è disponibile in lingua italiana e in lingua inglese. Il KID è disponibile nella lingua ufficiale locale del paese di distribuzione. Maggiori informazioni sulla politica dei reclami di AXA IM sono al seguente link: https://www.axa-im.it/avvertenze-legali/gestione-reclami. La sintesi dei diritti dell'investitore in inglese è disponibile sul sito web di AXA IM https://www.axa-im.com/important-information/summary-investor-rights.

I contenuti pubblicati nel presente sito internet hanno finalità informativa e non vanno intesi come ricerca in materia di investimenti o analisi su strumenti finanziari ai sensi della Direttiva MiFID II (2014/65/UE), raccomandazione, offerta o sollecitazione all’acquisto, alla sottoscrizione o alla vendita di strumenti finanziari o alla partecipazione a strategie commerciali da parte di AXA Investment Managers o di società ad essa affiliate, né la raccomandazione di una specifica strategia d'investimento o una raccomandazione personalizzata all'acquisto o alla vendita di titoli. L’investimento in qualsiasi fondo gestito o promosso da AXA Investment Managers o dalle società ad essa affiliate è accettato soltanto se proveniente da investitori che siano in possesso dei requisiti richiesti ai sensi del prospetto informativo in vigore e della relativa documentazione di offerta.

Il presente sito contiene informazioni parziali e le stime, le previsioni e i pareri qui espressi possono essere interpretati soggettivamente. Le informazioni fornite all’interno del presente sito non tengono conto degli obiettivi d’investimento individuali, della situazione finanziaria o di particolari bisogni del singolo utente. Qualsiasi opinione espressa nel presente sito internet non è una dichiarazione di fatto e non costituisce una consulenza di investimento. Le previsioni, le proiezioni o gli obiettivi sono solo indicativi e non sono garantiti in alcun modo. I rendimenti passati non sono indicativi di quelli futuri. Il valore degli investimenti e il reddito da essi derivante possono variare, sia in aumento che in diminuzione, e gli investitori potrebbero non recuperare l’importo originariamente investito.

Ancorché AXA Investment Managers impieghi ogni ragionevole sforzo per far sì che le informazioni contenute nel presente sito internet siano aggiornate ed accurate alla data di pubblicazione, non viene rilasciata alcuna garanzia in ordine all’accuratezza, affidabilità o completezza delle informazioni ivi fornite. AXA Investment Managers declina espressamente ogni responsabilità in ordine ad eventuali perdite derivanti, direttamente od indirettamente, dall’utilizzo, in qualsiasi forma e per qualsiasi finalità, delle informazioni e dei dati presenti sul sito.

AXA Investment Managers non è responsabile dell’accuratezza dei contenuti di altri siti internet eventualmente collegati a questo sito. L’esistenza di un collegamento ad un altro sito non implica approvazione da parte di AXA Investment Managers delle informazioni ivi fornite. Il contenuto del presente sito, ivi inclusi i dati, le informazioni, i grafici, i documenti, le immagini, i loghi e il nome del dominio, è di proprietà esclusiva di AXA Investment Managers e, salvo diversa specificazione, è coperto da copyright e protetto da ogni altra regolamentazione inerente alla proprietà intellettuale. In nessun caso è consentita la copia, riproduzione o diffusione delle informazioni contenute nel presente sito.

AXA Investment Managers può decidere di porre fine alle disposizioni adottate per la commercializzazione dei suoi organismi di investimento collettivo in conformità a quanto previsto dall'articolo 93 bis della direttiva 2009/65/CE.

AXA Investment Managers si riserva il diritto di aggiornare o rivedere il contenuto del presente sito internet senza preavviso.

A cura di AXA IM Paris – Sede Secondaria Italiana, Corso di Porta Romana, 68 - 20122 - Milano, sito internet www.axa-im.it.

© 2025 AXA Investment Managers. Tutti i diritti riservati.